bexar county tax assessor payment

You can pay by phone with your bank or credit card information. Address Phone Number and Hours for Bexar County Assessor an Assessor Office at Bandera Road San Antonio TX.

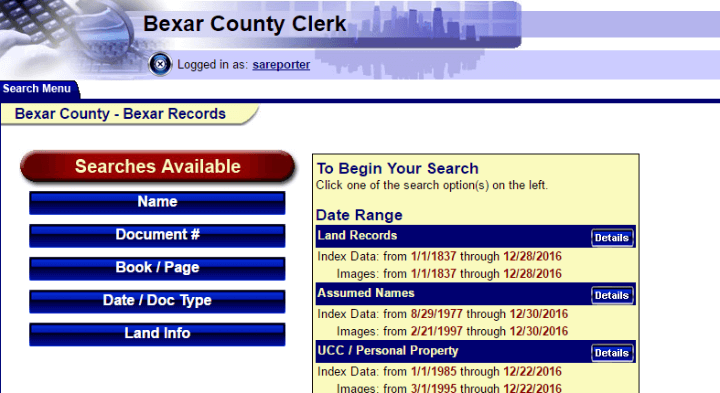

How To Research A Property S History Using Bexar County S Free Records Search John Tedesco

14 reviews of Bexar County Tax Assessor-Collector Yes Tracie was very professional and took care of all paper work no watting.

. Northeast - 3370 Nacogdoches Rd. If any active lawsuit exists for a previous year attorney fees are added to the 2021 tax bill on February 1 2022. P O BOX 839950.

View any Justice of Peace case information and make related payments through the Justice the Peace Online Payments system. For additional information you may contact the Tax Office at 210 335-2251 or visit the downtown location at. NOVEMBER 30 2021 - 1st HALF-PAYMENT due.

Important tax payment dates. BEXAR COUNTY TAX ASSESSOR-COLLECTOR. Bexar County Tax Office.

This County Tax Office works in partnership with our Vehicle Titles and Registration Division. Clicking on the link below will take you to to a webpage with specific information and instructions for making that type of payment through our convenient and secure online network. Northwest - 8407 Bandera Rd.

All amounts due include penalty interest and attorney fees when applicable. Bexar County provides three convenient ways to pay your property taxes. Property Tax Payment Options.

Mailed in October for any remaining balance due. Bexar County Assessor Contact Information. ALBERT URESTI MPA PCAC BEXAR COUNTY TAX ASSESSOR-COLLECTOR P O BOX 839950 SAN ANTONIO TX 78283-3950.

The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices. After locating the account you can also register to receive certified statements by e-mail. Unless otherwise noted all data refers to tax information for 2021.

SAN ANTONIO TX 78283-3950. Southside - 3505 Pleasanton Rd. To pre-pay their taxes in monthly installments through September 15.

BEXAR COUNTY TAX ASSESSOR-COLLECTOR. Unless otherwise noted all data refers to tax information for 2021. The Texas Alcoholic Beverage Commission collects State fees and surcharges.

Tax bills are sent out in October and are payable by January 31. Registration Renewals License Plates and Registration Stickers. Please select the type of payment you are interested in making from the options below.

ALBERT URESTI MPA PCAC. P O BOX 839950. SAN ANTONIO TX 78283-3950.

ALBERT URESTI MPA PCAC. You can pay your property taxes online with a major credit card or e-check using Bexar Countys online property tax payment portal. You can pay Bexar County property taxes online via credit card or electronic check.

You can search for any account whose property taxes are collected by the Bexar County Tax Office. In addition to Bexar County and the Flood Control Fund the Office of Albert Uresti Bexar County Tax Assessor-Collector has a contractual agreement to collect and disburse property taxes for 56 separate taxing jurisdictions. All amounts due include penalty interest and attorney fees when applicable.

County tax assessor-collector offices provide most vehicle title and registration services including. Search property by name address or property ID. Bexar County Payment Locations.

JANUARY 31 2022 - Last day to pay 2021 tax bill without penalty and interest. The Bexar County Tax Assessor-Collector appraises properties throughout the year and determines a valuation for each one by January 1. Tax bills are sent out in October and are payable by January 31.

P O BOX 839950. Please follow the instructions below. Click Here For Form.

ALBERT URESTI MPA PCAC. Unless exempt by law all real and business personal property are taxable. Downtown - 233 N.

Depending on start date. For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at 2103356628. Unless otherwise noted all data refers to tax information for 2021.

Property Tax Balance Begin a New Search Go to Your Portfolio. Property Tax Payments Online The Bexar County Tax Office offers the option of paying your Property Taxes online with either a major credit card or an electronic check ACH. After locating the account you can pay online by credit card or eCheck.

Pecos La Trinidad. Make your check or money order payable to. Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County.

Make your check or money order payable to. The Payment Assistance Grants for Delinquent Property Taxes is a federal program that Uresti says he is working with Congressman Joaquin Castro to make sure Bexar County residents qualify. Name Bexar County Assessor Address 8407 Bandera Road Ste 153 San Antonio Texas 78250 Phone 210-335-6435 Hours Open Daily 800 AM-630 PM.

All renewal fees and surcharges should be submitted to the TABC as the Bexar County Tax Assessor-Collectors Office does not accept payment for state renewals and original applications. OCTOBER 2021 - Tax statement mailing begins. Thank you for visiting the Bexar County ePayment Network.

SAN ANTONIO TX 78283-3950. All amounts due include penalty interest and attorney fees when applicable. A statement bill will be.

However licensees are responsible for paying the County portions of its fees. Property taxes must be current Equal payments are due. Of each tax year without penalty or interest.

Nice and clean yes security nice and tight lol overall not too bad nice building too lol. BEXAR COUNTY TAX ASSESSOR-COLLECTOR. Make your check or money order payable to.

Nelda Martinez On Twitter Bexar County San Antonio Tx Corpus Christi

Bexar County Considers 2 8b Budget Raises For Employees Officials

Showlist Bexar County Good Customer Service Acting

Public Service Announcement Residential Homestead Exemption

Bexar County Texas Fha Va And Usda Loan Information

Bexar County Tax Assessor Registration Services 233 N Pecos St San Antonio Tx Phone Number Yelp

Form Center Bexar County Tx Civicengage

Bexar Appraisal District Bexardistrict Twitter

Albert Uresti Bexar County Tax Assessor Collector In San Antonio Tx Bexar County County The Collector

How To Get To Albert Uresti Bexar County Tax Assessor Collector In San Antonio By Bus

County Commissioners Vote To Decrease Property Tax Rate In 2022

Bexar County Careers And Employment Indeed Com

Bexar County Considers 2 8b Budget Raises For Employees Officials

Cash Strapped Property Owners In Bexar County Face June 30 Tax Deadline Tax Deadline Bexar County Tax

Bexar County Tax Office To Stay Open But Close Lobbies What That Means For You

Payments Bexar County Tx Official Website

Property Tax Information Bexar County Tx Official Website

Michael Berlanga For Bexar County Tax Assessor Collector Facebook