san antonio property tax rate 2021

This budget will raise more total property taxes than last years budget by 26748510 or 44 and of that amount 11487636 is tax revenue to be raised from new property added to the tax roll this year. 2020 Official Tax Rates Exemptions.

Texas Lawmakers Pass Property Tax Cut For New Homeowners Next Relief For Seniors And The Disabled

Only property taxes levied on existing properties not new developments count toward the revenue growth calculation.

. San Antonio TX 78205 Phone. View photos map tax nearby homes for sale home values school info. In San Antonio the countys largest city and the second-largest city in the entire state the tax rate is 261.

Bexar County collects on average 212 of a propertys assessed fair market value as property tax. What is San Antonio property tax. 0133674 is for debt payments and the remaining 0342927 is for operations and maintenance in the general fund.

My husband is 100 disabled so our taxes dont go up as much. The Texas sales tax rate is currently 625. Published by at January 3 2022.

Counties in texas collect an average of 181 of a propertys assesed fair market value as property tax per year. Table of property tax rate information in Bexar County. Sam Owens Staff Photographer San Antonio Express-News.

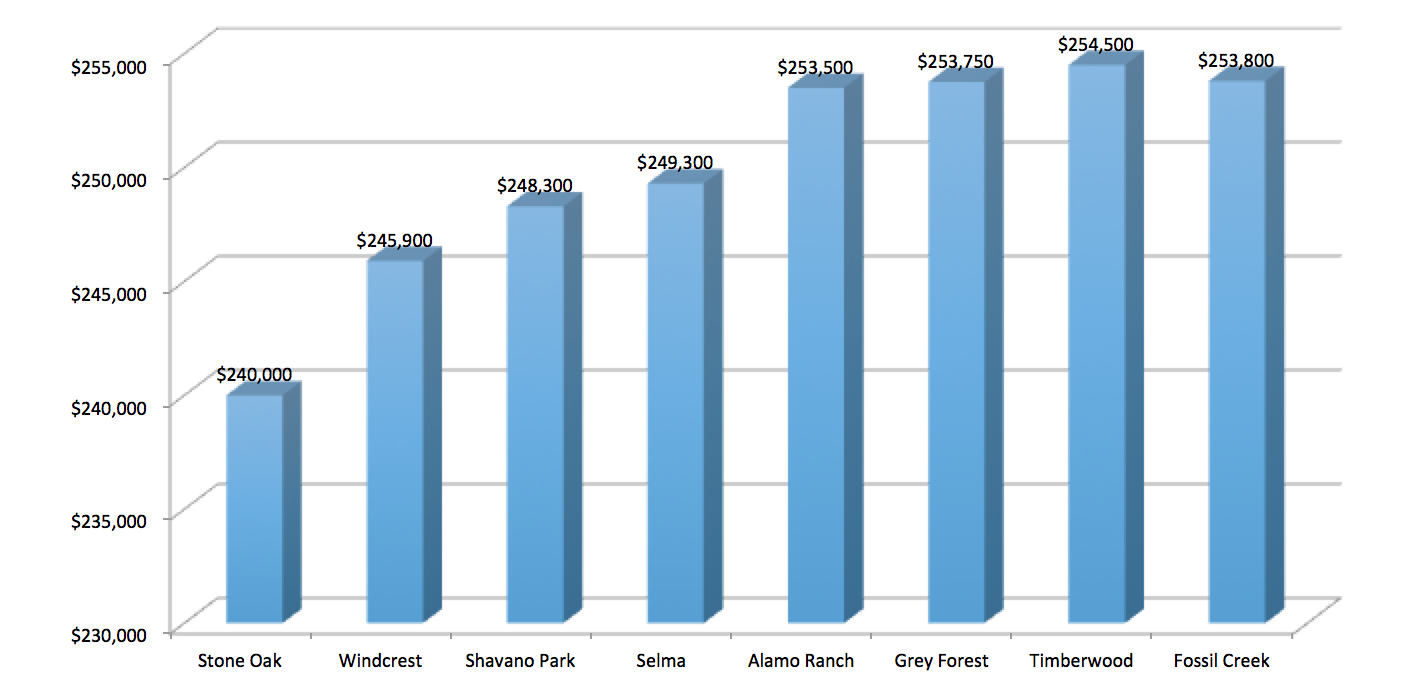

48 rows San Antonio. If you take the price of an average home in San Antonio 240000 and use this number in Alamo Ranch you would be looking at a yearly property tax bill of 533353. 2021 Official Tax Rates Exemptions.

Greg Abbott signed the new law Senate Bill 2 in 2019 and it took effect in 2021 when the citys property tax revenues increased by 31. The San Antonio sales tax rate is. The County sales tax rate is 0.

Property Tax Rate The property tax rate for the City of San Antonio consists of two components. This is the total of state county and city sales tax rates. The Commissioners Court also voted Tuesday to approve the proposed tax rate of 0301097 per 100 of valuation.

The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. Bexar County cuts its property tax rate a very little bit. 2021 Official Tax.

Public Sale of Property PDF. The current total local sales tax rate in san antonio tx is 8250. 39 rows Property Tax.

Maintenance Operations MO and Debt Service. Texas Association of Property Tax Professionals Annual Conference Renaissance Hotel Austin Texas TAPTP website. 2203 Santa Barbara is a 2 Beds 1 Full Bath s property in San Antonio TX 78201.

TEL 210 822-3331 FAX 210 822-8197. The average homeowner in Bexar County pays 2996 annually in property taxes on a median home value of 152400. Bexar County commissioners approved a 178 billion budget for the 2020-2021 fiscal year on Tuesday.

The minimum combined 2022 sales tax rate for San Antonio Texas is 825. They are however required to pay seven other types of property tax ranging from Northside ISD taxes to Bexar County Taxes creating a total tax rate of 222 per every hundred dollars. 14 2021 454 pm.

Little italy happy hour. The citys revenues for 2022 is 21. SAN ANTONIO In just the past four years Elsie Guzman has seen the value of her modest Denver Heights home more than double.

Truth in Taxation Summary PDF. Scott Huddleston Staff writer. The tax rate varies from year to year depending on the countys needs.

For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations. 2021 Annual International Conference on Assessment Administration Chicago Illinois IAAO website. Marriott San Antonio Rivercenter San Antonio Texas TAAD website.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. 2021 Official Tax Rates. San antonio property tax rate 2019.

You can print a 825 sales tax table here. The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value. There is no applicable county tax.

1 day agoRows of houses in the gated subdivision of Ridge at Canyon Springs in San Antonio Texas are pictured Wednesday Nov. As required by section 102005 b of the Texas Local Government Code the City San Antonio is providing the following Statement on this cover page of its FY 2021 Proposed Budget. Scott Ball San Antonio Report.

825 Is this data incorrect The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. Bexar County has one of the highest median property taxes in the United States and is ranked 282nd of the 3143 counties in order of median property taxes. San antonio property tax rate 2021.

6116 Broadway San Antonio TX 78209. The median property tax in Bexar County Texas is 2484 per year for a home worth the median value of 117100.

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Tac School Property Taxes By County

San Antonio Property Tax Rates H David Ballinger

Bexar County Commissioners Approve Slightly Reduced Tax Rate For 2022

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Tac School Property Taxes By County

The Difference A Year Makes For Homeownership Home Ownership Lowest Mortgage Rates Home Buying

San Antonio Suburb Approves Tax District Mixed Use Suburbs Districts

San Antonio Could Roll Back Its City Property Tax Rate Due To Higher Projected Revenues Tpr

Loudoun S Data Center Tax Revenue Is Accelerating At An Insane Pace Washington Business Journal

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

/https://static.texastribune.org/media/files/e6a25cb17ab2c3572ed710eb3748ddc0/Housing%20North%20Austin%20AI%20TT%2007.jpg)

Analysis Texas Property Tax Cut Measure Passed With The Long Game In Mind The Texas Tribune

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Ranking Of Best Places To Buy A House Based On Home Values Property Taxes Home Ownership Rates And Real Home Ownership Houses In America Real Estate Trends

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

2021 Real Estate Market Real Estate Infographic Real Estate Marketing Marketing

Why Are Texas Property Taxes So High Home Tax Solutions

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity